6 Easy Facts About Mileagewise - Reconstructing Mileage Logs Described

Table of ContentsMileagewise - Reconstructing Mileage Logs Fundamentals ExplainedFacts About Mileagewise - Reconstructing Mileage Logs UncoveredAn Unbiased View of Mileagewise - Reconstructing Mileage LogsWhat Does Mileagewise - Reconstructing Mileage Logs Do?Mileagewise - Reconstructing Mileage Logs for DummiesMore About Mileagewise - Reconstructing Mileage LogsExcitement About Mileagewise - Reconstructing Mileage Logs

Timeero's Fastest Range attribute recommends the quickest driving route to your workers' location. This function boosts productivity and adds to cost financial savings, making it a vital possession for companies with a mobile workforce. Timeero's Suggested Path feature even more increases liability and effectiveness. Workers can contrast the recommended path with the actual route taken.Such a method to reporting and compliance simplifies the typically intricate job of managing gas mileage costs. There are several advantages related to making use of Timeero to maintain track of gas mileage. Let's have a look at some of the app's most remarkable functions. With a relied on gas mileage monitoring tool, like Timeero there is no requirement to bother with unintentionally omitting a day or piece of details on timesheets when tax obligation time comes.

Some Known Details About Mileagewise - Reconstructing Mileage Logs

These additional verification steps will keep the IRS from having a factor to object your gas mileage documents. With accurate gas mileage monitoring modern technology, your staff members do not have to make rough gas mileage estimates or even stress concerning mileage expenditure tracking.

For example, if a staff member drove 20,000 miles and 10,000 miles are business-related, you can cross out 50% of all car costs. You will need to proceed tracking gas mileage for job also if you're utilizing the real expenditure method. Maintaining gas mileage documents is the only means to different business and individual miles and give the proof to the internal revenue service

Many mileage trackers let you log your journeys manually while computing the distance and reimbursement amounts for you. Lots of also included real-time trip monitoring - you require to begin the app at the beginning of your journey and quit it when you reach your last destination. These applications log your begin and end addresses, and time stamps, together with the complete range and repayment amount.

Unknown Facts About Mileagewise - Reconstructing Mileage Logs

One of the concerns that The IRS states that vehicle expenses can be thought about as an "ordinary and needed" cost throughout working. This consists of prices such as gas, upkeep, insurance policy, and the automobile's devaluation. For these prices to be taken into consideration deductible, the lorry should be utilized for service purposes.

Mileagewise - Reconstructing Mileage Logs Can Be Fun For Anyone

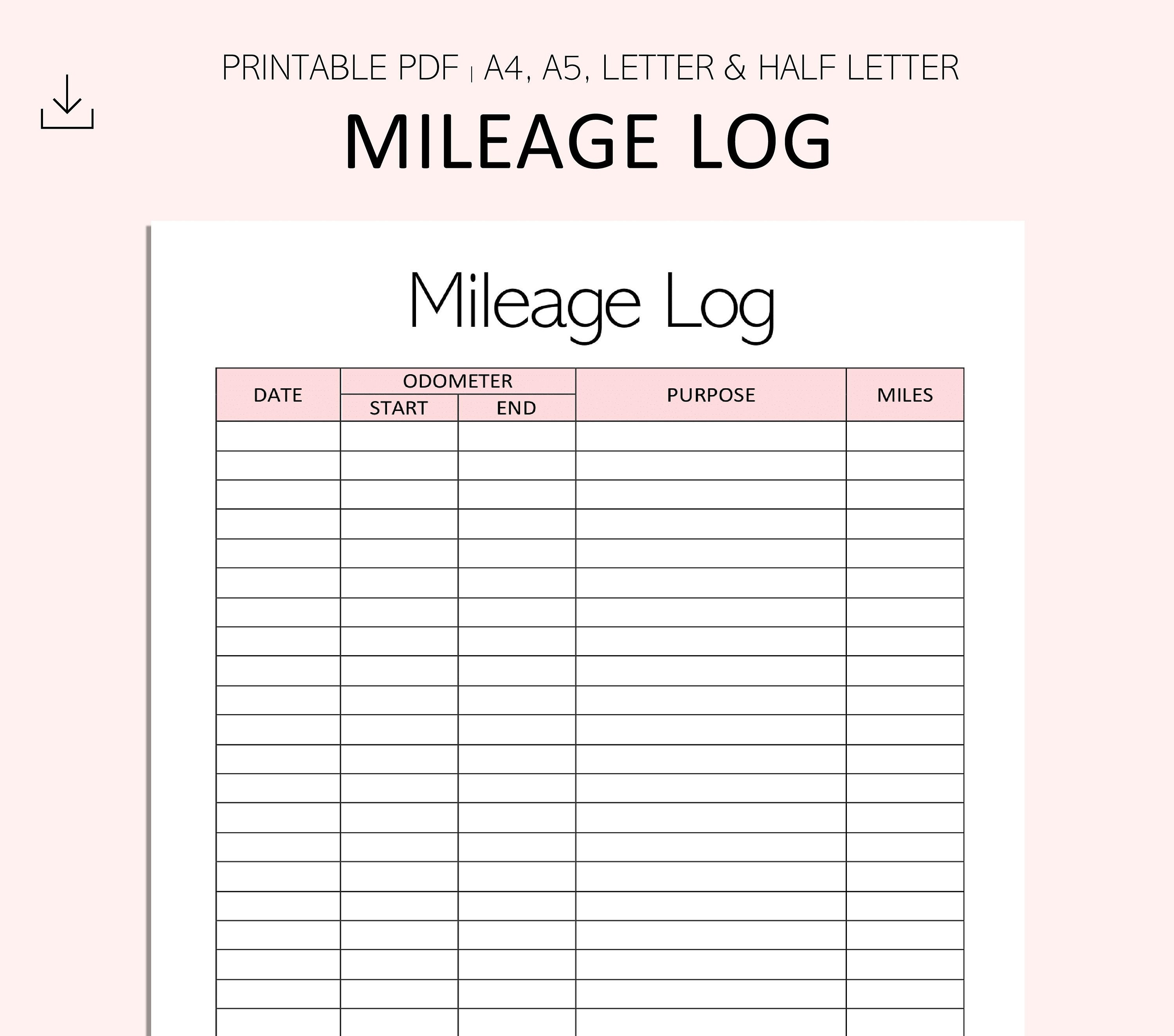

In in between, carefully track all your service trips noting down the beginning and ending analyses. For each journey, document the place and service objective.

This consists of the total business mileage and total gas mileage buildup for the year (service + individual), journey's date, location, and purpose. It's essential to tape-record activities without delay and keep a coexisting driving log outlining day, miles driven, and organization function. Right here's exactly how you can enhance record-keeping for audit functions: Beginning with making certain a careful mileage log for all business-related traveling.

Mileagewise - Reconstructing Mileage Logs for Beginners

The real costs method is an alternate to the standard gas mileage rate approach. Rather of computing your deduction based upon a fixed rate per mile, the actual expenses approach enables you to subtract the actual expenses connected with using your automobile for organization purposes - mile tracker app. These expenses consist of gas, upkeep, repairs, insurance policy, depreciation, and various other relevant expenses

Those with significant vehicle-related expenditures or one-of-a-kind conditions might benefit from the real costs approach. Please note choosing S-corp condition can change this computation. Ultimately, your selected method ought to straighten with your specific financial objectives and tax obligation circumstance. The Standard Mileage Price is a procedure issued each year by the internal revenue service to establish the deductible costs of operating an automobile for service.

Mileagewise - Reconstructing Mileage Logs for Beginners

Maintaining track of your mileage manually can need diligence, yet remember, it might conserve you cash on your taxes. Videotape the complete gas mileage driven.

Not known Facts About Mileagewise - Reconstructing Mileage Logs

And now nearly every person utilizes GPS to get around. That indicates virtually everyone can be tracked as they go concerning their service.

Comments on “The smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Talking About”